Frequently Asked Questions

For more information on the Thrive Together Fund, please take a look at our webinar.

What is the Thrive Together Fund?

The fund looks to expand the reach of social investment to smaller organisations or those based in disadvantaged areas, by providing an unrestricted funding package of loan (75%) and grant (25%) and by working with specialist delivery partners.

The target audience is eligible small to medium sized charities and social enterprises based in and delivering social/ environmental impact in England, and who are looking to grow or diversify their business models.

The fund is managed by SIB, and delivered in partnership with Co-operative and Community Finance, Fredericks Foundation, Groundwork, Homeless Link and The Architectural Heritage Fund.

Is there a minimum or maximum amount that I can request?

You can apply for between £25,000 to £150,000 (inclusive of the grant element). This will be made up of a fixed amount of 75% loan, and 25% grant.

Is there a minimum or maximum repayment term for the loan element?

You can repay the loan over a term of between 1 to 6 years (inclusive of any capital repayment holiday). There is the option of up to a 12-month capital repayment holiday at the start of the loan – interest will still be payable from month one. We will consider affordability and the term of your loan during the assessment of your application.

How much will I be charged for the loan element?

The loan will be charged at a rate of 7.5% fixed per annum on the loan balance. Interest is calculated on the declining outstanding balance. You will also be charged an arrangement fee of 2% on the value of the loan which will be added to your loan balance. You can prepay the loan at any time without penalty.

Will I need to provide security for the loan element?

The fund is intended to provide unsecured loans. We would only take security by exception (if at all) and only after very careful consideration and with the agreement of the organisation.

Can I have a grant without the loan?

No. The fund offers loan funding, with a 25% grant that sits alongside the loan to help make it more accessible and affordable for smaller charities and social enterprises, or those based in disadvantaged areas. The fund is not intended to provide standalone grant funding.

What can I use the funding for?

The funding can be used for most purposes, including the refinancing of existing debt.

Here are some examples of the types of things the funding could be used for – purchasing an asset, redeveloping/ refurbishing/ improving an asset, continuing or growing a product or service, working capital for ongoing operating expenses, acquisition.

Whatever you apply for, you must be able to demonstrate that you will generate sufficient and suitable income to repay the loan element.

I want to use the funding to refinance existing debt, is this allowed?

The 75% loan element can be used to refinance existing debt over a more patient period. The 25% grant element cannot be used for refinancing.

Do we have to meet all eligibility criteria?

You must be an incorporated voluntary, community or social enterprise organisation, based in and delivering social/ environmental impact in England. You must also be registered in England as either a Charity, Community Interest Company or Community Benefit Society or, if you are another type of legal entity, you must have a social object, asset lock and restriction on profit distribution (must distribute less than 50% of post-tax profits) written into your governing documents. You must also have a viable borrowing request (that can reasonably be expected to meet its repayment obligations).

You should also have a minimum of two years’ operating activity and a minimum turnover of £100k in your last financial year. However, the Fund will consider cases outside of this criteria on an exceptional basis. If you meet all other eligibility criteria, you have a viable borrowing request, and you think the loan element is affordable please contact SIB or one of the fund Partners to discuss your application further.

What does incorporated mean?

The organisation is registered as a legal entity e.g. a company and can take out contracts and borrowing in its own name.

Is anything ineligible?

The following sectors are ineligible:

- Deposit taking Banks and EEA Banks;

- Building Societies;

- Insurers (other than insurance brokers);

- Public sector organisations (as classified by the Office of National Statistics);

- State funded primary or secondary schools.

Will the fund lend alongside other lenders?

The fund can make loans alongside other lenders or grant providers. However, consideration will be given to how the overall investment will affect an organisation’s financial position and its ability to repay the loan element.

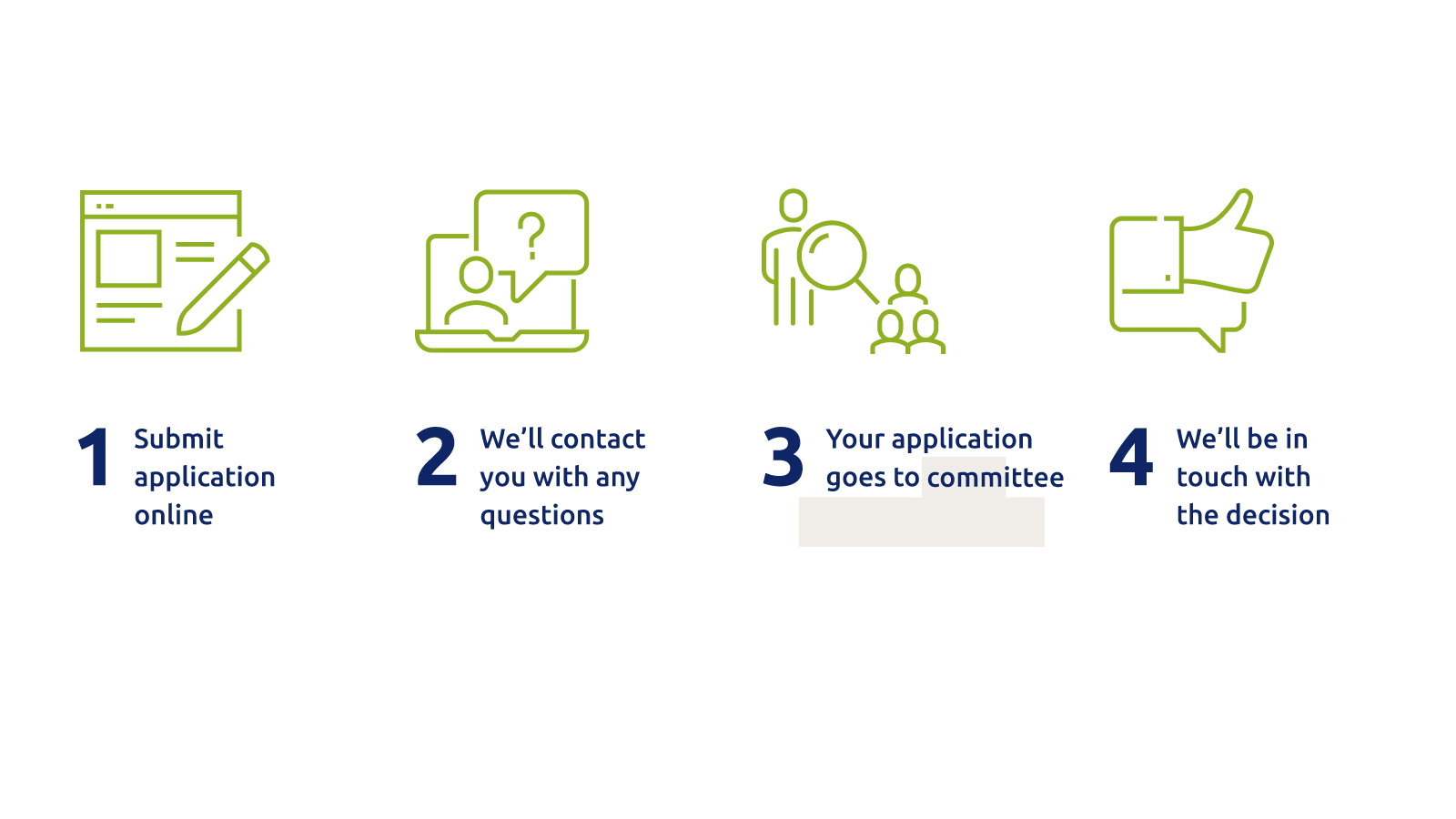

What should I expect when completing the application form?

The application is relatively straight forward. It collects mostly contact information and organisation data. It doesn’t have lots of free text questions.

You will be asked to select a partner to assess your application and, if applicable, present it to the funds investment committee for a decision (see below). You will also be asked to provide your last 2 sets of approved accounts (showing figures for 3 years, if available), latest set of management accounts, and 12-month cashflow forecast for the current financial year.

The application should take approximately 15 minutes to complete if you have all information to hand. You can save the application and resume later, if needed. Once submitted you will receive an auto acknowledgement email with a PDF copy of your application attached. We will be in touch a few days after you have submitted.

How do I decide which partner to work with?

When you fill in your application you will be asked to select a partner to assess your application, and, if applicable, they will present it to the funds investment committee. It probably makes sense for you to select a partner that works in a similar sector to you or one you have an existing relationship with. However, it is entirely up to you which partner you decide to work with.

When we receive your application, if we think it would make sense for a different partner, to the one you have selected, to assess your application e.g. because they could offer a more holistic package of support, we will discuss this with you.

Here is a list of the partners and the sectors they work in:

| Partner |

Sector/ Specialism |

| Co-operative and Community Finance |

Co-operatives and social enterprises |

| Fredericks Foundation |

Smaller/ earlier stage social enterprises |

| Groundwork |

Community action on poverty and the environment |

| Homeless Link |

Organisations tackling homelessness |

| The Architectural Heritage Fund |

Conservation and sustainable re-use of historic buildings |

| Social Investment Business |

Charities and social enterprises |

Our registered address is different from our main premises – is that a problem?

That’s fine.

What are the Subsidy requirements?

To find out more about the requirements, please visit out Subsidy Guidance.