Businesses have taken on a magnitude of debt to stay afloat during the pandemic through government guaranteed lending schemes, as well as rent holidays and other commercial loans. There is a real danger that the high levels of corporate indebtedness will prolong any economic downturn precipitated by the pandemic and hinder the recovery.

Despite the Bank of England recently finding that a third of small businesses were highly in debt – alongside further economic headwinds from supply chain issues, inflation and Brexit – the Autumn Budget gave no indication that the Government is taking the corporate debt issue seriously.

We are most concerned about areas that are facing a ‘perfect storm’ of (i) poor or sluggish local economic recovery, (ii) a high cumulative uptake from furlough scheme, (iii) high levels of government backed debt and (iv) pre-existing levels of deprivation.

The majority of the Government’s business support schemes have now tapered or closed following the easing of restrictions. As the scale of the debt burden becomes clearer, the most at-risk areas could see a marked increase in unemployment and business insolvency. This could create long-term scarring in places and communities that were already struggling before the pandemic hit.

Our analysis of the data has found:

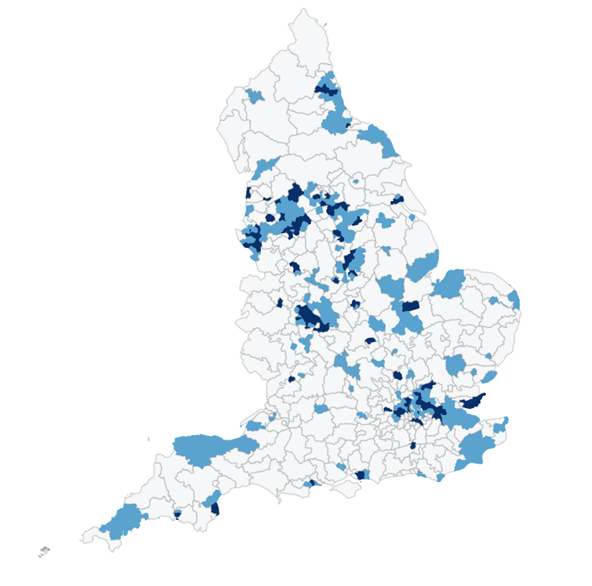

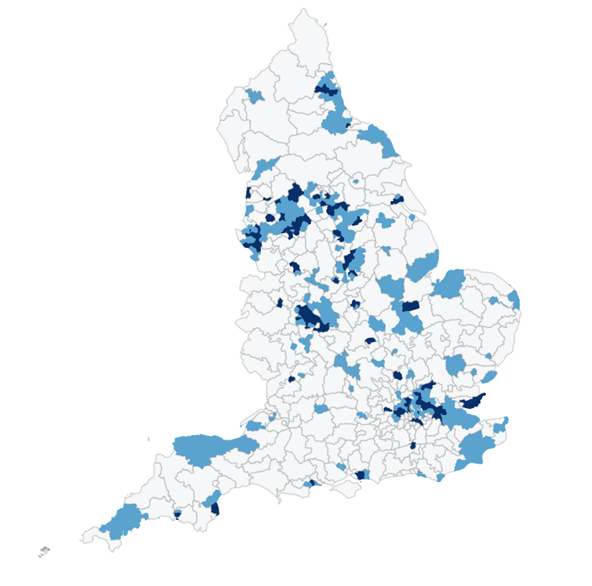

- The concentration of debt is evenly spread across the country: whilst the highest levels of debt are in London and the North West, and there are certain hotspots of indebtedness around other urban areas, there is no clear regional distribution to the levels of government-backed debt.

- However, the most at-risk constituencies are heavily concentrated in the North West, London and West Midlands: when debt is combined with additional compounding economic pressures – including local economic recession, cumulative furlough uptake and deprivation – it reveals a set of places that are at serious risk of long-term scarring. Constituencies in the North West, London and the West Midlands account for almost two thirds of the 20% most at-risk constituencies.

- Urban constituencies – particularly those in core cities – are at significantly higher risk than rural areas: based on our analysis, 9 in 10 of the 20% most at-risk constituencies are in either a city or large town – with constituencies in the core cities and London alone accounting for 4 in 10 of the 20% most at-risk constituencies.

The scale of Government backed lending presents a rare opportunity to think about ways of providing debt relief, while also encouraging alternative ownership models like employee, worker or community ownership. This has the potential to ease pressure on SMEs, protect jobs and create a more inclusive and social economy.

Our report calls on the Government, banks and social impact investors to explore ambitious debt-for-equity solutions that could ease pressure on firms’ balance sheets, but also turbocharge the Government’s levelling up agenda by empowering the workforce, democratising corporate governance and including more people in the wealth creation process.

Read the full report here.

Top 50% (light blue) and 20% (dark blue) IMD-weighted at-risk constituencies.