Application questions and guidance

In total the application should take around 1 hour to complete and is broken down into the following core sections:

- Information about the person completing the application

- Eligibility checker

- Organisation details

- Diversity, Equity and Inclusion data

- Funding request/Intended use of grant

- Evidence of need

- Subsidy

- Supporting information

- Declaration and submission of your application

Most questions are factual and ask you to select one of the options we have provided to you. You must complete questions marked by a (M).

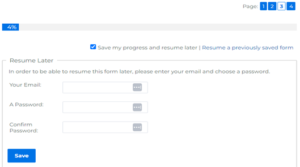

It is possible to save your application progress and resume later. Once you have ticked the box shown in the image below, you will be asked to enter your email address and create a password for the form. Please make sure that you enter your email address accurately and use a password that you will be able to remember.

Below you will find guidance on the questions that may need further explanation to help you complete your application.

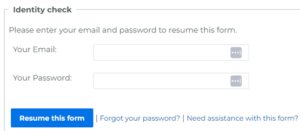

To resume an application you have previously saved, please revisit the application form link and then click on ‘Resume a previously saved form’.

You will then be asked to enter the email address and password that you gave when you saved the form.

If you have forgotten your password, you can reset it by clicking on ‘Forgot your password?’.

1. Information About You

Please confirm the key contact details for the person who is making this application on behalf of your organisation (M)

Marketing preferences (M)

If you would like to hear more about Social Investment Business and our work, you have the option to sign up to our newsletter/promotional information, by selecting yes or no.

2. Eligibility Checker

Select yes for each of the statements to confirm your eligibility for this fund. If you have any questions about this, please email us at grants@sibgroup.org.uk or call us on 020 8156 0020 during normal office hours.

3. Organisation Details

This section asks you to provide some basic information about the organisation that is applying.

What is the organisation’s legal name? (M)

When entering the name of your organisation it is very important that you enter your legal name as registered at Companies House/ the Charity Commission/ the FCA Mutuals Register. We have to undertake some background checks on all organisations that apply to us for funding and having the correct legal name is key to this. Also, if successful, we will need to send you grant documentation in your legal name.

Is your organisation known by another name? (M)

If your organisation trades under a name which is different to its legal name, please select ‘yes’ and then enter the details of your trading name.

Company Number (M)

This is the unique registration number that identifies your organisation at either Companies House or the FCA Mutuals Register.

If you are registered as a Charitable Incorporated Organisation, please enter your charity number; this will mean that you have entered the same number in both the company number and charity number boxes.

If you are on the Mutuals Register, please put 0’s at the start of your number to ensure the number is a minimum of 7 digits. If you are not a company please put in one zero.

Charity Number

Your charity number is the unique registration number that identifies organisations registered as charities with the Charity Commission. If you are a registered charity as well as a company, please still enter your charity number. If you are registered as a Charitable Incorporated Organisation, please enter your charity number; this will mean that you have entered the same number in both the charity number and company number boxes. If you are not a registered charity, please leave this box blank.

On what date was the organisation established? (M)

By this we mean when did your organisation become a registered legal entity by registering with either Companies House, the Charity Commission or the FCA Mutuals Register.

Organisation Street/Building, Town/City, County, Region, Post Code (M)

This is the address you have registered with Companies House/the Charity Commission or the FCA Mutuals Register.

What is the organisation’s scale of delivery? (M)

Please tell us about the size of the area you deliver most of your services to by selecting the most appropriate option.

- Local indicates that you only deliver services in and around the place where your organisation is based, such as a neighbourhood, city or local authority area.

- Regional indicates that you deliver services in multiple places across the region where your organisation is based.Such as multiple areas across the North East for example.

- Multi-regional indicates that you deliver services in more than one of the English regions. Regions are: South East, London, North West, East of England, West Midlands, South West, Yorkshire and the Humber, East Midlands, North East.

- National indicates that you deliver services across the England or the UK

Provide up to three postcodes of the places where your organisation benefits local people to help us understand where you work? (M)

We understand that often where organisations are based or registered might not be where your services are delivered. So that we can better understand where you are working, please provide us with up to 3 postcodes of the areas for where you are currently delivering activities.

We also understand that some postcode areas are very small, and you could be operating across more than 3. So please provide 3 postcodes which cover the areas where you work with the largest numbers of people, or which are most indicative of the communities you serve.

What is the main activity of your organisation? (M)

Please select from the list provided the outcome area which best describes your main focus. We understand that you may work in several outcome areas, but please select the one which you mainly work in.

Who are the primary beneficiaries of the organisation’s services? (M) Please select the option that best matches.

- People experiencing long term unemployment

- People who are homeless

- People with addiction issues

- People with long-term health conditions

- People with learning difficulties

- People with physical disabilities or sensory impairment

- People with mental health needs Vulnerable parents

- Vulnerable children

- Vulnerable young people

- Vulnerable older people including people with dementia

- Ex-offenders

- People who have experienced crime or abuse

- People living in poverty and/or financially excluded

How many people do you work with each year? (M)

Please provide the most recent figures for the people you are providing services and support to.

How many additional people will you work with as a result of this grant? (M)

In addition to the number of people you work with in a year, how many more people will this grant enable you to support? We will not be assessing or comparing numbers, each community has different needs and complexities this is only to provide some information of the additional need you might be able to meet through this grant.

What is the organisation’s legal status? (M)

Please select from the drop down list your organisation’s legal status as registered with Companies House and/or the Charity Commission /or the FCA Mutuals Register:

- Charitable Incorporated Organisation

- Company Limited by Guarantee

- Company Limited by Shares

- Community Interest Company Limited by Guarantee

- Community Interest Company Limited by Shares

- Industrial and Provident Society

- Limited Liability Partnership

- Local Authority

- Mutual (Friendly Society)

- Registered Society (BenCom is a Community Benefit Society)

- Registered Society (Cooperative)

- Unincorporated

- Other (If you select Legal Structure is Other, please specify this)

Can you give us a brief description of the organisation/social enterprise (M) (Maximum of 200 words)

This should include a brief outline of the main aims of the organisation, the business model, who it supports and how it operates.

What was the organisation’s turnover as per its last set of accounts? (M)

Your turnover is the income your organisation has generated. Please enter the total amount of income your organisation had as detailed in the last set of published accounts.

How many income streams does the organisation have? (M)

An income stream is money that is coming into your organisation on a regular basis.

For example, if your organisation is selling products to the public, as well as generating income through governmental contracts, it will have 2 income streams.

Please indicate how many income streams you have by selecting the appropriate option.

Where does the organisation’s primary income come from? (M)

Your primary income is your main source of income. Please select the option that best describes where your main source of income comes from.

- Business 2 Business (B2B) means providing goods and/or services to other businesses.

- Business 2 Customer (B2C) means providing goods and/or services to individuals (and the individuals pay for these themselves).

- Business 2 Government – Contracts means providing goods and/or services to local, devolved, or central government bodies.

- Business 2 Government – Grants means grants you receive from local, devolved, or central government bodies.

- Donations means donations or fundraising income you receive from the general public.

What percentage of the organisation’s income does (or will it) earn from trading? (M)

Please tell us how much of your total income comes from trading. By trading we mean the sale of goods and/or services to either other businesses, individuals or via contracts with any government bodies. If you currently don’t trade, please provide an estimate as your expectation of future trading in the next 12 months.

What percentage of the organisation’s income does it receive from grants, donations, and gifts? (M)

Choose the most suitable percentage answer for your organisation.

What policies do you have in place? (M)

Please select which policies you have in place.

4. How diverse is your organisation’s board and senior management team?

What percentage of your board and senior management team are:

BAME-Led, Disability-Led, LGBTQ+ -Led, Woman-Led (M)

Please select a relevant % for each category or choose ‘prefer not to say’.

5. Funding Request

What is the total amount of funding you are applying for? (M)

You can apply for up to £25,000, please enter the amount of funding you will need to provide more support to people and/or communities most impacted by the Cost of Living crisis.

Are you applying for an incentivised grant?* (M)

Please select Yes, No or Not sure

An incentivised grant is a grant to support progress towards an agreed set of targets to further develop, grow or scale your enterprise to support people most impacted by the Cost of Living crisis (e.g. X many additional people impacted by the cost-of-living crisis receive support as a result of the grant).

If you are unsure which type of grant would best suit your needs, please describe how you would like to use the grant in the questions below and if successful we can work with you to determine which type of grant would be the best fit.

Are you applying for a match trading grant?* (M)

Please select Yes, No or Not sure

A Match trading grant is grant-funding that pound-for-pound matches an increase in income from trading (e.g. £10,000 of matched grant from this fund following £10,000 of income raised by you)

If you are unsure which type of grant would best suit your needs, please describe how you would like to use the grant in the questions below and if successful we can work with you to determine which type of grant would be the best fit.

*For this fund you must answer yes for either an incentivised or match trading grant

How will this grant help you continue to build trading income? (Maximum of approximately 400 words)

How will this match trading or incentivised grant help you to build trading income further.

6. Evidence of need

How is the Cost of Living crisis affecting your organisation? (Maximum of 400 words)

The Cost of Living crisis has impacted staff and organisations in a number of different ways including but not limited to struggling to recruit and retain staff, dealing with increased costs of delivering services, increased operating costs and struggling to meet demand for services. Please choose the options that best describe how the Cost of Living crisis has impacted on your staff and organisation.

Please tell us about the people & communities you support and how the Cost of Living crisis is affecting them? (Maximum of 400 words)

The Cost of Living crisis has impacted on people and communities in different ways including but not limited to food, energy and financial insecurity, housing and increased mental health needs. Please describe how the Cost of Living crisis is affecting the people and/or communities you support.

What is the main purpose of the grant? (M)

Select the most appropriate option from the list below:

- Grow through existing/product or service

- Grow through geographical expansion/customer segment diversification

- Grow through new product or service

- Improve product or service

What are you planning to spend the grant on? (M)

Select the most appropriate answer from the options provided on the form.

If successful, how will the grant help you to support more people impacted by the Cost of Living crisis? (Maximum of 400 words)

We would like to know how this grant will enable you to support more people impacted by the Cost of Living crisis, so please provide as much details as possible within the word limit.

7. Subsidy

Has your organisation received Subsidy in the current or previous two financial years? (M)

Please note, your previous Enterprise Development Programme grant(s) is/are a Subsidy Grant and therefore would need to be listed in this section.

Explanation of Subsidy

Subsidy (previously known as State Aid) is where a public authority – for example central, or local government – provides support to an enterprise that gives them an economic advantage, meaning equivalent support could not have been obtained on commercial terms. Economic advantage can take the form of a grant, a tax break, a loan, guarantee or equity investment on favourable terms, or the use of facilities below market price, amongst other kinds of support.

The purpose of the subsidy control regime is to prevent public authorities from giving financial advantages to enterprises in a way that could distort competition.

Grants qualify within the definition of Subsidy, and we must therefore abide by the UK Subsidy Control Rules.

We have determined that grant awards under this fund are likely to fall outside of the Subsidy Control Rules restrictions due to an applicable exemption. Minimal Financial Assistance (MFA) under Chapter 2 of the Subsidy Control Act 2022 (SCA 22) allows grantees to receive subsidies as long as the amount of subsidies received in the last three financial years (including the Grant under this Fund) do not exceed the current threshold of £315,000.

Questions around Subsidy help us to identify the Subsidy position of your application. You are required to provide details of any subsidy (or previously, EU State Aid) support received to date.

In the event that all or any part of the Grant is deemed by a Court or other agency of competent jurisdiction not to comply with the Subsidy Control Rules, we may recover all or that part of the Grant from you.

If you are concerned about Subsidy, you must seek independent legal advice.

If you answer yes to the previous question, please provide the total amount of Subsidy in the current and previous two fiscal years (M)

Please can you tell us the total amount of previous “relevant subsidies” that your organisation has received in the current and previous two fiscal years.

Definitions

“Fiscal year” = a period of 12 months ending with 31 March.

“Current fiscal year” = the time elapsed in the fiscal year in which the relevant subsidy is given together.

More details about Subsidy can be found on our webpage here.

8. Supporting Information

Financial Accounts (M)

Provide a copy of your most recent accounts for the last financial year. If not published, please provide draft accounts if available.

You can upload a PDF version of this using the file attachment button.

Please upload the latest set of management accounts (M)

This should be for the current financial year to date. Make sure this includes a profit and loss statement and balance sheet.

You can upload a PDF version of this using the file attachment button.

9. Submit your application

Please read the declaration provided and tick the box provided to confirm you have read the statements within it (M).

In particular the declaration is asking you to confirm

- That all the information you have provided in the application is true and correct

- That you are authorised to submit this application on behalf of your organisation, and the application is supported by your Trustees/Directors

If you are successful in receiving a grant through this fund, the terms and conditions of the documentation we will issue to you will refer to your application, so it is very important that everything within this form is accurate.

Make sure you follow the onscreen prompts to ensure your application is successfully submitted. You should receive a copy of your application via email once this has been submitted successfully, and you may wish to check your spam/junk folders if you don’t receive this.

The deadline for applications is Monday 6th November at 4pm.