COVID-19: what happens next?

Today we launched a data partnership with Tortoise. Our Director of Learning and Influence Genevieve Maitland Hudson shares more on SIB’s immediate investment in data work to understand how the pandemic, and the lock down, is affecting communities and local areas, and what happens next.

The COVID-19 pandemic is a multifaceted crisis. For now we are focused on the direct risk to life, as we should be. Beyond that immediate concern, the pandemic may not yet have manifested its deepest and most enduring legacy in British society. That legacy is still hunkered down in living rooms and kitchens up and down the country as we wait to see how the global economy, the national economy, the climate, and our holiday habits, amongst many other things, are altered for the short, medium or very long term.

The social economy will certainly be absorbing a substantive hit. Many small social businesses – and most are small – are mothballed, reduced or have pivoted fast towards remote delivery. They have limited reserves, modest amounts of cash in bank accounts to pay staff and creditors, and many are ineligible for government support packages.

Our own data collection is telling us that SIB investees with smaller turnovers are at highest risk due to Covid-19. Those with turnovers of £100k – £500k are most precarious and face a heightened service risk. Only 11/83 of our investees sampled so far (13%) have fully open premises, most have closed – 23% forcibly, 29% voluntarily. Those 31% that have adapted their delivery, have the largest share of their workforce able to work from home. Having cash in the bank seems to be the most significant variable, as opposed to profitability or overall balance sheet, allowing investees to continue to pay their staff and creditors, and the smaller the turnover, the smaller the amount of cash in hand. Our sample is not a representative one, only 98 social businesses overall, but it points us towards important trends, and we will continue to build on it.

Support from trusts, foundations and social investors is currently focused on the immediate emergency, and that short-term emergency means cash, on the right terms, and fast. We need to find ways to meet that need, as we are doing in part through the Resilience and Recovery Loan Fund and on emergency grant rounds with our partners Power to Change and on the Youth Endowment Fund; this in addition to providing flexibility to existing customers on repayments.

Short term emergency funding is, well, just that though, short term. The next question we need to ask ourselves is: what happens next? How can we best target our funds in the medium term, how should we design and deliver that ongoing funding, towards which businesses, operating in which sectors and in which parts of the country?

Above all, what is the substantive role that the social economy should play in a post-COVID Britain?

At SIB, we want to be in an informed position as we move towards the recovery phase, to know where we should concentrate our efforts and be most active in offering support and in deploying finance as effectively as we can. This is why we have invested immediately in understanding how the pandemic, and the lock down, is affecting communities and local areas. The data and analysis we’ve been working on will give us effective, time-sensitive rolling updates of their economic health as the lock down eases and we slowly get back to work as normal.

The SIB barometer is based on granular ward level data that we access through the Impact Information Company (Imfoco). SIB have been working with Imfoco for several years, and we were able to set up our barometer quickly to track the effects of the pandemic on local economies. Through our data partnership in the Social Economy Data Lab, SIB has obtained and analysed national data sets on merchant sales and customer wallet share at ward level, and matched and merged that data with other data sets to provide a useful and actionable set of insights that we will continually update in coming weeks.

The core of this work is based on an underlying data set of transactions that are matched to Merchant Identification codes to track spending in consumer-facing businesses. The data set covers a range of sources including high street banks in Great Britain, and across the country accounts for a range of between 12% and 27% of the population who have a bank account. Sample sizes across the country are substantive, even at ward level they offer robust insight into patterns of spending. Bank accounts are UK-based, and therefore the data gives an accurate picture of the spending of British people.

So what does it tell us?

Well, it tells us that COVID-19 has accelerated and concentrated effects that we were already tracking. There has been an immediate and substantive localising effect on spending as people stick close to home to do their grocery shopping. Shopping centres have been hit hard. Both of these trends pre-existed the pandemic, but the effects of the coronavirus will underscore and deepen their impact.

Understanding overlaps between analyses and data sets is key to making the most of the information that we are analysing in the barometer. There is more to come here, but as an example, the Centre for Progressive Policy (CPP) used the figures published by the OBR on the likely impact on the UK economy resulting from the coronavirus crisis to provide a localised analysis for every local authority district in the UK. The OBR expects real GDP to fall by 35% in the second quarter of 2020. This 35% decrease was calculated as an average of the likely impact on different sectors, weighted according to the size of each sector in the national economy; CPP applied this same methodology to local authorities, weighting the average sectoral hit by the distribution of each local authority’s Gross Value Added (GVA) by sector.

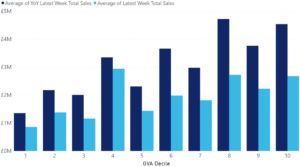

We ran this analysis against our own and found that its findings are inversely correlated with consumer spending effects as seen in our data. The chart below shows our analyses plotted against the GVA drops predicted by the CPP. Higher deciles represent places with lower expected falls in GVA. If this is right, then national responses could easily focus on GVA drops of this kind, taking a macro picture of economic impact, and in doing so miss significant localised economic impacts being experienced often by the poorest places, and by those on the lowest incomes.

Despite the GVA predictions, in these areas we are seeing very significant drops in spending in recent weeks as compared to our average benchmark (in dark blue).

These are only two data points. The findings are rich, and we will be publishing regular updates every week for the next six weeks in partnership with Tortoise. You can read a more in depth analysis here, on Tortoise’s website (the link gives free access), and here, on the Social Economy Data Lab website.

We have two key interests in sharing and expanding on these analyses:

to establish where the pandemic is hitting hardest, taking time to understand its effects on areas already struggling,

and to understand where the social economy fits into this picture, both where it is caught up in its negative impact, and just as importantly where it is playing a key role in palliating its effects.

Please keep following this work as it is updated over the coming weeks, and do share any data, insights and ideas with the Social Economy Data Lab.

If you’re looking for a breakdown of the latest Government advice for businesses, and current emergency funding opportunities, visit our COVID-19 Resources and Information page.

Photo by Nick Romanov on Unsplash